What Is Tax Base Amount . the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. what is tax base? How much of your income is above your personal allowance; income tax is the single most important source of revenue for the uk treasury, accounting for about a quarter of total tax revenue. tax rates and bands. how much income tax you pay in each tax year depends on: Tax is paid on the amount of taxable income remaining after the personal allowance. It is levied on most forms. Tax base refers to the total income (including salary, income from investments, assets, etc.).

from www.slideserve.com

Tax base refers to the total income (including salary, income from investments, assets, etc.). income tax is the single most important source of revenue for the uk treasury, accounting for about a quarter of total tax revenue. Tax is paid on the amount of taxable income remaining after the personal allowance. how much income tax you pay in each tax year depends on: the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. It is levied on most forms. what is tax base? How much of your income is above your personal allowance; tax rates and bands.

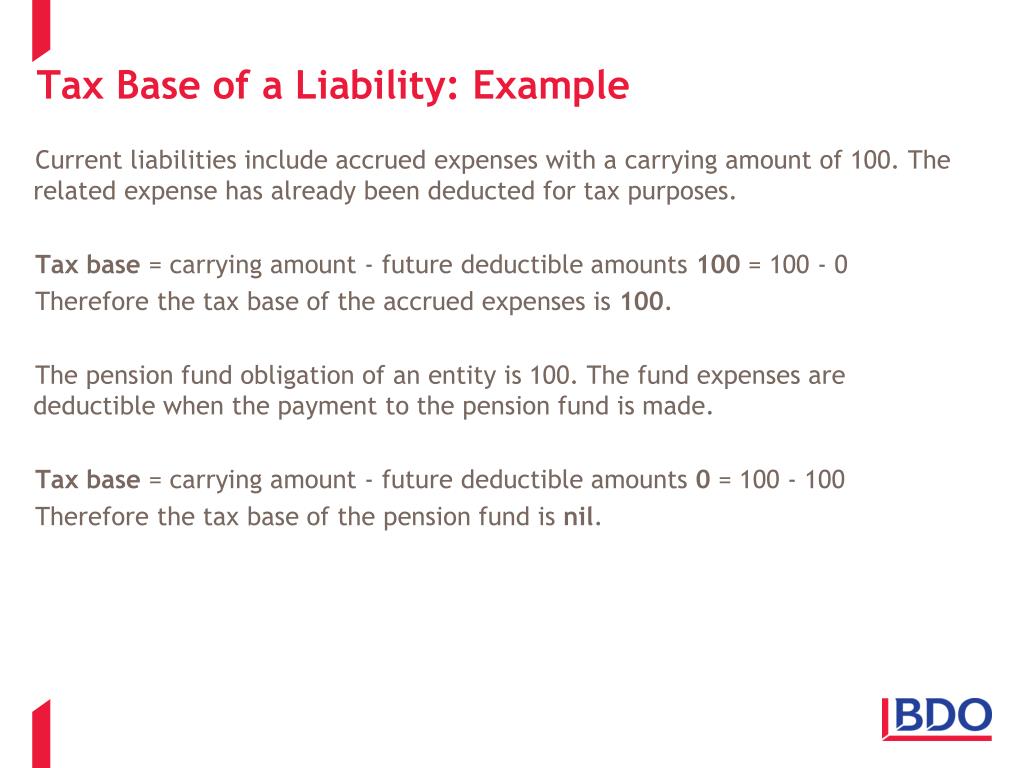

PPT IAS 12 Taxes PowerPoint Presentation, free download ID69645

What Is Tax Base Amount income tax is the single most important source of revenue for the uk treasury, accounting for about a quarter of total tax revenue. income tax is the single most important source of revenue for the uk treasury, accounting for about a quarter of total tax revenue. what is tax base? How much of your income is above your personal allowance; how much income tax you pay in each tax year depends on: It is levied on most forms. the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. tax rates and bands. Tax is paid on the amount of taxable income remaining after the personal allowance. Tax base refers to the total income (including salary, income from investments, assets, etc.).

From corvee.com

What is Basis? Corvee What Is Tax Base Amount Tax is paid on the amount of taxable income remaining after the personal allowance. Tax base refers to the total income (including salary, income from investments, assets, etc.). what is tax base? the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. It. What Is Tax Base Amount.

From www.slideserve.com

PPT Chapter 14 Taxes and Government Spending PowerPoint Presentation What Is Tax Base Amount how much income tax you pay in each tax year depends on: It is levied on most forms. income tax is the single most important source of revenue for the uk treasury, accounting for about a quarter of total tax revenue. Tax base refers to the total income (including salary, income from investments, assets, etc.). tax rates. What Is Tax Base Amount.

From www.slideserve.com

PPT Tax Preparation PowerPoint Presentation, free download ID1544233 What Is Tax Base Amount tax rates and bands. income tax is the single most important source of revenue for the uk treasury, accounting for about a quarter of total tax revenue. Tax is paid on the amount of taxable income remaining after the personal allowance. the tax base of an asset is a tax authority’s calculation of an asset’s impact on. What Is Tax Base Amount.

From exceljet.net

Tax rate calculation with fixed base Excel formula Exceljet What Is Tax Base Amount Tax is paid on the amount of taxable income remaining after the personal allowance. It is levied on most forms. the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. How much of your income is above your personal allowance; Tax base refers to. What Is Tax Base Amount.

From federalwithholdingtables.net

2021 IRS Tax Brackets Table Federal Withholding Tables 2021 What Is Tax Base Amount It is levied on most forms. tax rates and bands. what is tax base? the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. how much income tax you pay in each tax year depends on: income tax is the. What Is Tax Base Amount.

From www.slideserve.com

PPT Chapter 1 PowerPoint Presentation, free download ID6663613 What Is Tax Base Amount what is tax base? Tax base refers to the total income (including salary, income from investments, assets, etc.). Tax is paid on the amount of taxable income remaining after the personal allowance. the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. . What Is Tax Base Amount.

From www.slideserve.com

PPT IAS 12 Taxes PowerPoint Presentation, free download ID69645 What Is Tax Base Amount tax rates and bands. Tax is paid on the amount of taxable income remaining after the personal allowance. the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. income tax is the single most important source of revenue for the uk treasury,. What Is Tax Base Amount.

From www.slideserve.com

PPT taxes IAS 12 PowerPoint Presentation, free download ID What Is Tax Base Amount the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. Tax base refers to the total income (including salary, income from investments, assets, etc.). income tax is the single most important source of revenue for the uk treasury, accounting for about a quarter. What Is Tax Base Amount.

From www.youtube.com

Accounting for Tax Part 3/7 YouTube What Is Tax Base Amount what is tax base? tax rates and bands. It is levied on most forms. Tax is paid on the amount of taxable income remaining after the personal allowance. How much of your income is above your personal allowance; the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l). What Is Tax Base Amount.

From freedomandprosperity.org

Understanding the “Tax Base” Dan Mitchell What Is Tax Base Amount It is levied on most forms. Tax base refers to the total income (including salary, income from investments, assets, etc.). income tax is the single most important source of revenue for the uk treasury, accounting for about a quarter of total tax revenue. what is tax base? How much of your income is above your personal allowance; . What Is Tax Base Amount.

From www.chegg.com

Solved Q1 a) What is a tax base and how are the tax bases What Is Tax Base Amount Tax base refers to the total income (including salary, income from investments, assets, etc.). how much income tax you pay in each tax year depends on: It is levied on most forms. what is tax base? Tax is paid on the amount of taxable income remaining after the personal allowance. How much of your income is above your. What Is Tax Base Amount.

From www.wallstreetmojo.com

Tax Base What Is It, Example, Formula, Vs Carrying Amount What Is Tax Base Amount the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. Tax is paid on the amount of taxable income remaining after the personal allowance. How much of your income is above your personal allowance; what is tax base? how much income tax. What Is Tax Base Amount.

From www.slideserve.com

PPT Ch. 14 Government Revenue and Spending PowerPoint Presentation What Is Tax Base Amount Tax base refers to the total income (including salary, income from investments, assets, etc.). what is tax base? Tax is paid on the amount of taxable income remaining after the personal allowance. how much income tax you pay in each tax year depends on: tax rates and bands. How much of your income is above your personal. What Is Tax Base Amount.

From www.slideserve.com

PPT IAS 12 Taxes PowerPoint Presentation ID3410369 What Is Tax Base Amount tax rates and bands. the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. what is tax base? How much of your income is above your personal allowance; income tax is the single most important source of revenue for the uk. What Is Tax Base Amount.

From www.slideserve.com

PPT Taxes and Taxation PowerPoint Presentation, free download ID What Is Tax Base Amount the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. Tax base refers to the total income (including salary, income from investments, assets, etc.). tax rates and bands. what is tax base? How much of your income is above your personal allowance;. What Is Tax Base Amount.

From www.wikihow.com

How to Calculate Federal Tax 11 Steps (with Pictures) What Is Tax Base Amount How much of your income is above your personal allowance; the tax base of an asset is a tax authority’s calculation of an asset’s impact on taxable income (p&l) through asset adjustments that differ from. Tax is paid on the amount of taxable income remaining after the personal allowance. income tax is the single most important source of. What Is Tax Base Amount.

From www.educba.com

Taxable Formula Calculator (Examples with Excel Template) What Is Tax Base Amount how much income tax you pay in each tax year depends on: what is tax base? How much of your income is above your personal allowance; Tax base refers to the total income (including salary, income from investments, assets, etc.). income tax is the single most important source of revenue for the uk treasury, accounting for about. What Is Tax Base Amount.

From www.slideserve.com

PPT Ch. 14 Government Revenue and Spending PowerPoint Presentation What Is Tax Base Amount what is tax base? Tax is paid on the amount of taxable income remaining after the personal allowance. how much income tax you pay in each tax year depends on: income tax is the single most important source of revenue for the uk treasury, accounting for about a quarter of total tax revenue. Tax base refers to. What Is Tax Base Amount.